Category: Publications

Beneficial Ownership Information Reporting Requirements Revision and Deadline Extension

SBCA Corporate Transparency Act Comments 2025(6768619.1)

Read MoreSBCA Leadership Team and Upcoming Events

Dear SBCA Members, As we embark on what will certainly be an interesting and exciting final...

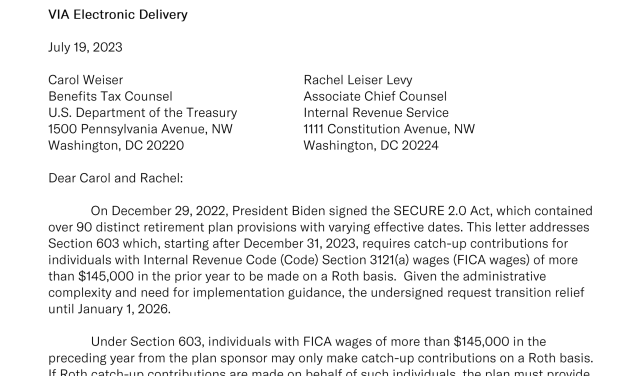

Read MoreTreasury/IRS Roth Transition Letter

Roth Treasury Transition Letter Final(5264200.1)

Read More2022 Special Congressional Award Winner Joe Manchin

This video was provided by Senator Manchin to accept the SBCA’s 2022 Special Congressional Award...

Read MoreSimplified PPP Loan Forgiveness Application

While the SBCA continues to work in support of legislation to simplify the PPP loan forgiveness...

Read MoreRetirement Plan Contribution Limits for 2020

Each year the IRS makes cost of living adjustments to many of the limits on benefits from –...

Read MoreELECTRONIC DISCLOSURES: DEPARTMENT OF LABOR DISCOVERS E-MAIL AND THE INTERNET

The US Department of Labor has suddenly realized that employers and their employees use a...

Read MoreWatch out for the SECURE Act: Two Terrible Provisions for Small Businesses with Retirement Plans and their Employees

The SECURE Act recently passed by the House of Representatives contains two very negative...

Read MoreApril 2016 Final DOL Fiduciary Retirement Investment Advice Regulation

For Certain Tax Deferred Investments Intended To Reduce Adviser Conflicts Of Interest

Read MoreSocial Security Windows of Opportunity

In the wee hours of the morning today (October 30, 2015), the Senate passed the budget bill, along...

Read More